欧洲油价官司案例分析_欧洲油价官司案例分析题

1.期货案例分析,求大神指导,详细点。回答的好的话。追加50-70分。谢谢了。

2.对销贸易案例分析

期货案例分析,求大神指导,详细点。回答的好的话。追加50-70分。谢谢了。

老兄,貌似你一个问题问几遍。。。

顺带麻烦一下,采纳的话别帮我把贴删除。这样分数都会归零。。。

1肯定是做多,题目第2问告诉你了。原因主要是资金面和宏观面。资金面上,外汇储备激增,通货加剧,人民币供应量肯定很大,迟早反映在股市上。宏观面的话,全球经济都不怎么样,就中国好些,很多资金都会被吸引过来。

2假设你买20手合约。其实也差不多,基金不能承担太大风险,一般100万资金只能做单手合约。2000万做20手。一共盈利500点,每点300元,总共盈利500*300*20 - 30*20= 300万-600元。

第二个问题

1假设三个操作,

买入看涨期权,行权价每桶150美元, 378万桶/年

卖出看跌期权,行权价每桶62.35美元,757万桶/年

卖出看涨期权,行权价每桶200美元, 300万桶/年

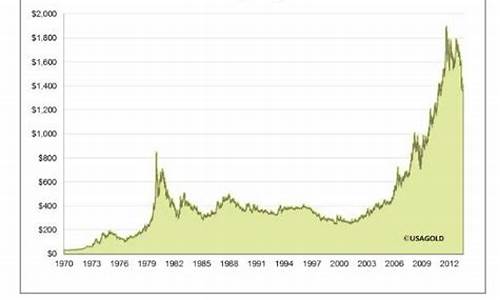

你最好自己去画个图说明一下。。。这样比较清楚。基本上油价在62,35以下,每低1美元,就亏757万。62,35到150之间,基本没有盈亏。150到200,每涨1美元,能赚378万。200美元以上,每涨1美元,只赚78万。

2看看上面的情况,就知道,东航买了很多万桶,其实就是个饭桶。。。明明什么都不懂,就被别人蒙骗。。。当然了,也不是没明白人,主要问题是体制。。。没法多说。

第二点,油价低于62美元的敞口太大,完全不合理。油价暴跌的话,就是个死。事实上,东航的做法简直像个基金,这根本不是套期保值,分明就是个赌徒行为,而且还是个很拙劣的赌徒,完全无视胜率。。。

正确的操作,就是简单地买进看涨期权,卖出等量(或略有出入)的看跌期权就可以了。

对销贸易案例分析

我只有英语的案例,希望对你有帮助。

the goods had sent, my customer J told me this is the last order between our two companies with the product without CE and ROHS. In the future, he only do business with us on the condition of our goods with CE and ROHS certificate at hand. J sent me an E-mail to express his interest on our desk lamp, and asked to send him the product information with picture. I am happy to receive his inquiry, while I am not sure if I could bring this order into a successful conclusion. As no customer placed order with me on our desk lamp before, and my boss told me our desk lamp isn't the suitable items for export by its big shape, my duty is to focus on the other products with a small appearance and cheaper price. For my customer doesn't asked me to offer the price according to his demand in his E-mail, and no feedback comes after several weeks since my reply had sent, so I guessed my boss is right, maybe our customer just want to take a look at our product only. Another E-mail came after two months or so, asked me if we have the CE and ROHS certificate already for our desk lamp, my answer is we are going to apply for the certificates, then no E-mail followed after a long time.

声明:本站所有文章资源内容,如无特殊说明或标注,均为采集网络资源。如若本站内容侵犯了原著者的合法权益,可联系本站删除。